Blue Vikings Income Fund

Blue Vikings Income Fund offers accredited investors a unique opportunity to earn fixed returns through a diversified portfolio of real estate loans, while keeping their investment funds liquid. The Fund provides short-term loans to experienced real estate investors for property acquisition and renovation.

Invest Alongside Us - Become An Apartment Complex Owner!

In addition to our Blue Vikings Income Fund, we vet countless real estate investment opportunities. When we find a winner, we invest in it, and then invite our Blue Vikings Investor Club members to invest alongside us. We focus primarily of apartment complexes - the asset class trusted by the most millionaires on the planet. We help you invest passively in these cash flowing assets without the headache of being a landlord.

Join the Blue Vikings Investor Club (membership is free), to get access to all our investment opportunities. Many of these opportunities are never made available to the general public.

Are You a Parent of a Child with Special Needs?

STRATEGIES

FOR IMMEDIATE CASHFLOW & EMERGENCY FUNDS: Blue Vikings Income Fund

- We partner with investors seeking steady passive income through short-term, asset-backed real estate loans. Our fund provides first-position loans to experienced real estate investors, generating fixed returns of 7-10% for our investors.

- Investors enjoy monthly distribution and full liquidity after the initial six months, making this an ideal option for both immediate cash flow and emergency fund accessibility.

- Investor returns are determined solely by investment amount, providing stable, predictable income independent of fund performance. By spreading investments across multiple loans, we reduce risk through diversification. For those who don’t need immediate cash flow, returns can be compounded to accelerate long-term wealth growth.

FOR LONG-TERM WEALTH: Value-Add Multifamily Apartment Complexes

- We look for partners that are acquiring underperforming apartment complexes whose value can be increased through quality renovations and professional property management.

- Their business plan should identify opportunities for increased income, and wisely manage property operating expenses. This forces the value of properties to increase faster than regular appreciation.

- We believe in quality, so we look for renovation plans that use high-end luxury vinyl flooring, soft-close cabinetry, and granite countertops. These durable improvements reduce maintenance costs and increase retention of quality tenants, thereby increasing the value of the investment property.

DOWNLOAD OUR FREE BOOK

How Smart People Build Wealth - Passively

Whether choosing your first OR YOUR NEXT passive investment, this book is instrumental in understanding the most important aspects to look for in wining investments. It covers key topics such as:

- Types of Returns You Can Expect to Achieve

- The Top 5 Things to Consider When Investing in Real Estate

- Incredible Tax Benefits of Commercial Real Estate Investing

- Why Commercial Real Estate is So Profitable

- How to Determine if You are an Accredited Investor

- How to Find Investment Opportunities

- Best Ways to Fund Your Investment

.png)

CHECK OUT OUR BLOG SECTION

Multifamily Partnerships: How to Invest Together in Apartment Complexes and Grow Stronger

Imagine building wealth without doing all the work yourself. Imagine earning money from real estate, but without fixing toilets, chasing tenants, or managing a property on your own. Many people dream of this, but only a few know the easiest way to make it real. That way is through multifamily partnerships.

If you want a simpler path to financial growth — one that does not require you to be a landlord — then learning how to invest with others in multifamily real estate can change everything.

…How to Build Trust with Your Money in a Changing Economy

The world feels different from what it used to be. Prices change. Markets move fast. News headlines can be confusing or even scary. Many people work hard, save carefully, and still feel unsure about where their money belongs.

If you have ever asked yourself, “Can I trust where my money is right now?” You are not alone.

In a changing economy, trust matters more than ever. Trust your plan. Trust in your investments. Trust that your money is doing what it is supposed to do.

Why So Many People…

Demographic Shifts That Will Shape Multifamily Demand This Year

The demand for multifamily rental housing is closely tied to how people live, work, and move. In 2026, several key demographic trends will influence where renters choose to live and what kind of properties are in demand. These changes matter for investors, developers, and anyone interested in the future of multifamily real estate.

Young Adults Driving Rental Demand

Younger generations, especially Millennials and Gen Z, continue to shape the rental market in important ways. Many of these ad…

EVENTS IN WHICH WE HAVE BEEN FEATURED:

Bigger Checks, Better Terms and Less Stress

LISTEN HERE

Invest With Your Wallet and Heart

Purpose Driven a Recession Resistant Real Estate Investing

Invest With Your Wallet and Your Heart

Multifamily Syndication and Housing for Autistic Adults

How to Use Real Estate Syndications to Change the World

SPILLING THE BEANS WITH TIM BRATZ: MAXIMIZING YOUR PASSIVE INVESTMENTS

FREE WEBINAR: 5 WAYS TO START INVESTING IN REAL ESTATE

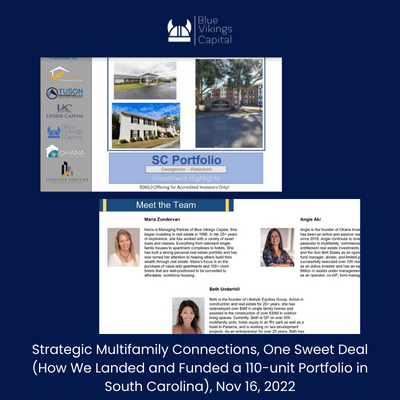

STRATEGIC MULTIFAMILY CONNECTIONS, One Sweet Deal

CENTRAL FLORIDA REALTY INVESTORS (CFRI), Landlording

HERO CAPITAL RAISING SUMMIT

FUND OF FUNDS WEBINAR

SIGN UP FOR INVESTMENT OPPORTUNITIES

Join the Blue Vikings Investor Network to get access to all our investment opportunities. Many of these opportunities are never made available to the general public.